Introduction

Forex trading is a lucrative and exciting venture for those who have the skills and knowledge to navigate the market successfully. One of the essential skills to master is the use of candlestick patterns to analyze market trends and make informed trading decisions. In this article, we will explore the Doji candlestick pattern and how to use it effectively in forex trading.

What is a Doji Candlestick Pattern?

A Doji candlestick pattern is a type of candlestick pattern that indicates indecision or neutrality in the market. It is formed when the opening and closing prices are equal or almost equal, resulting in a small or non-existent body with long upper and lower wicks. The pattern can occur in both bullish and bearish markets and is usually seen as a sign of potential reversal or continuation of the trend.

Types of Doji Candlestick Patterns

There are several types of Doji candlestick patterns, each with its unique characteristics and implications for trading. They include:

1. Standard Doji

A standard Doji is formed when the opening and closing prices are equal, resulting in a small or non-existent body with long upper and lower wicks. It signals indecision in the market, and traders should look for confirmation of the trend before making a trading decision.

2. Long-Legged Doji

A long-legged Doji is characterized by long upper and lower wicks, indicating high volatility and uncertainty in the market. It is usually seen as a sign of potential reversal, and traders should be cautious before entering a trade.

3. Dragonfly Doji

A Dragonfly Doji is formed when the opening price, closing price, and low price are equal, and the high price has a long upper wick. It is seen as a bullish signal and may indicate a potential reversal of the trend.

4. Gravestone Doji

A Gravestone Doji is the opposite of a Dragonfly Doji, and it is formed when the opening price, closing price, and high price are equal, and the low price has a long lower wick. It is seen as a bearish signal and may indicate a potential reversal of the trend.

How to Use the Doji Candlestick Pattern in Forex Trading

The Doji candlestick pattern is a powerful tool in forex trading, and traders can use it in various ways to make informed trading decisions. Some effective ways to use the Doji candlestick pattern include:

1. Identify Potential Reversal Points

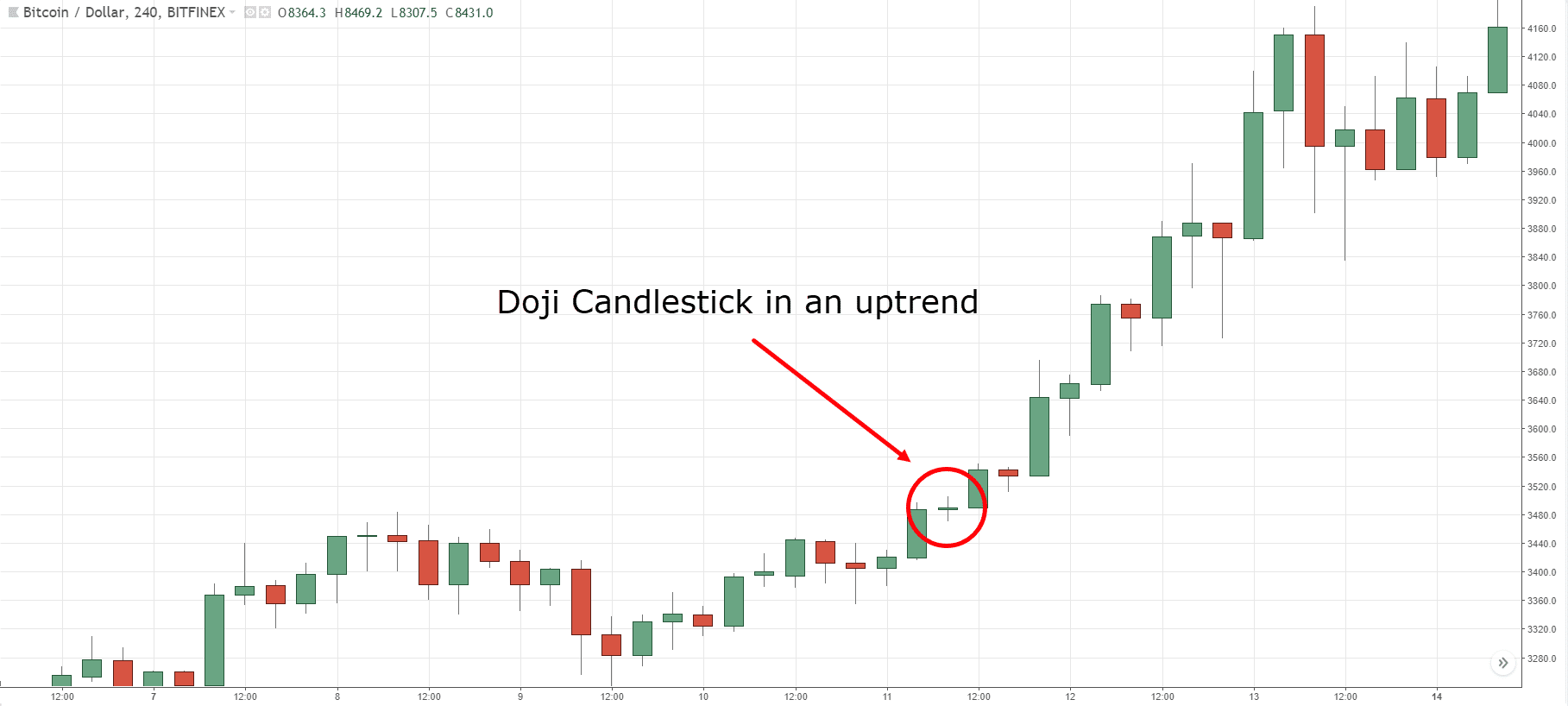

The Doji candlestick pattern can be used to identify potential reversal points in the market. Traders should look for a Doji pattern after a significant uptrend or downtrend as it may indicate a potential reversal of the trend.

2. Confirm the Trend

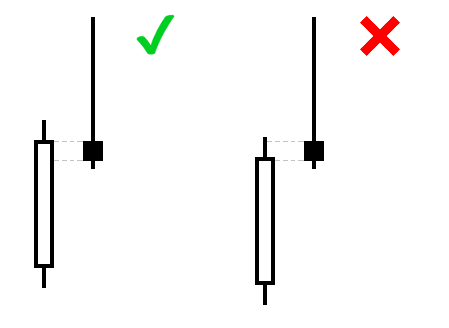

Traders can use the Doji candlestick pattern to confirm the trend in the market. If the Doji pattern appears after a significant uptrend, it may indicate that the trend is losing momentum, and traders should be cautious before entering a long position. Conversely, if the Doji pattern appears after a significant downtrend, it may indicate that the trend is losing momentum, and traders should be cautious before entering a short position.

3. Use as a Stop Loss Level

Traders can use the Doji candlestick pattern as a stop loss level for their trades. If a trader enters a long position after a significant uptrend and a Doji pattern appears, they can set their stop loss level at the low of the Doji pattern. This will help to limit their losses in case the trend reverses.

4. Use as an Entry Point

Traders can also use the Doji candlestick pattern as an entry point for their trades. For example, if a Doji pattern appears after a significant downtrend, and the next candlestick closes higher, it may indicate a potential reversal of the trend. Traders can enter a long position at the open of the next candlestick and set their stop loss level at the low of the Doji pattern.

5. Combine with Other Indicators

Traders can also combine the Doji candlestick pattern with other indicators to increase the accuracy of their trading decisions. For example, they can use the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm the trend and identify potential entry and exit points.

Conclusion

The Doji candlestick pattern is a powerful tool in forex trading and can be used in various ways to make informed trading decisions. Traders should familiarize themselves with the different types of Doji patterns and how to use them effectively to identify potential reversal points, confirm the trend, use as a stop loss or entry point, and combine with other indicators for increased accuracy. With practice and patience, traders can master the use of the Doji candlestick pattern and improve their success in forex trading.

FAQs

- What is a candlestick pattern in forex trading?

- A candlestick pattern is a type of charting technique used in forex trading to analyze and interpret market trends. It is based on the use of candlestick charts, which display the price action of an asset over a specific period.

- A candlestick pattern is a type of charting technique used in forex trading to analyze and interpret market trends. It is based on the use of candlestick charts, which display the price action of an asset over a specific period.

- How do I identify a Doji candlestick pattern?

- A Doji candlestick pattern is identified by the presence of a small or non-existent body with long upper and lower wicks. The opening and closing prices are equal or almost equal, indicating indecision or neutrality in the market.

- A Doji candlestick pattern is identified by the presence of a small or non-existent body with long upper and lower wicks. The opening and closing prices are equal or almost equal, indicating indecision or neutrality in the market.

- What is the significance of a Doji candlestick pattern in forex trading?

- A Doji candlestick pattern can indicate potential reversal or continuation of the trend. Traders should use it to confirm the trend, identify potential entry and exit points, and set stop loss levels.

- A Doji candlestick pattern can indicate potential reversal or continuation of the trend. Traders should use it to confirm the trend, identify potential entry and exit points, and set stop loss levels.

- Can the Doji candlestick pattern be used in combination with other indicators?

- Yes, traders can combine the Doji candlestick pattern with other indicators such as RSI or MACD to increase the accuracy of their trading decisions.

- Yes, traders can combine the Doji candlestick pattern with other indicators such as RSI or MACD to increase the accuracy of their trading decisions.

- How can I improve my success in forex trading using the Doji candlestick pattern?

- Traders can improve their success in forex trading by familiarizing themselves with the different types of Doji patterns, practicing with demo accounts, and using the pattern in combination with other indicators for increased accuracy.

- Traders can improve their success in forex trading by familiarizing themselves with the different types of Doji patterns, practicing with demo accounts, and using the pattern in combination with other indicators for increased accuracy.

- What are the different types of Doji patterns?

- There are four main types of Doji patterns: long-legged Doji, gravestone Doji, dragonfly Doji, and four-price Doji. Each pattern has its own characteristics and significance in forex trading.

- There are four main types of Doji patterns: long-legged Doji, gravestone Doji, dragonfly Doji, and four-price Doji. Each pattern has its own characteristics and significance in forex trading.

- Can the Doji candlestick pattern be used in other financial markets besides forex?

- Yes, the Doji candlestick pattern can be used in other financial markets such as stocks, commodities, and cryptocurrencies. Traders should adapt their strategies accordingly and consider the volatility and liquidity of each market.

- Yes, the Doji candlestick pattern can be used in other financial markets such as stocks, commodities, and cryptocurrencies. Traders should adapt their strategies accordingly and consider the volatility and liquidity of each market.

- Is the Doji candlestick pattern a reliable indicator for forex trading?

- The Doji candlestick pattern is a reliable indicator when used in combination with other indicators and analysis techniques. Traders should not rely solely on the Doji pattern for their trading decisions and should consider the broader market context.

- The Doji candlestick pattern is a reliable indicator when used in combination with other indicators and analysis techniques. Traders should not rely solely on the Doji pattern for their trading decisions and should consider the broader market context.

- Can beginner traders use the Doji candlestick pattern?

- Yes, beginner traders can use the Doji candlestick pattern as a starting point for their analysis and trading decisions. However, they should familiarize themselves with the basic concepts of forex trading and risk management before entering the market.

- Yes, beginner traders can use the Doji candlestick pattern as a starting point for their analysis and trading decisions. However, they should familiarize themselves with the basic concepts of forex trading and risk management before entering the market.

- How can I learn more about forex trading and candlestick patterns?

- Traders can learn more about forex trading and candlestick patterns through online courses, books, seminars, and mentorship programs. It is important to choose reputable sources and to practice with demo accounts before trading with real money.