Forex trading can seem like a complex and daunting world, especially for beginners. However, with the right knowledge and resources, anyone can get started and potentially profit from trading foreign currencies. In this beginner’s guide, we will cover everything you need to know to get started with forex trading.

:max_bytes(150000):strip_icc()/GettyImages-1071247604-f0fd7789f14e41b59e37f82657330400.jpg)

Table of Contents

- Understanding Forex Trading

- What is Forex Trading?

- How Does Forex Trading Work?

- Getting Started with Forex Trading

- Finding a Broker

- Creating a Trading Account

- Understanding Trading Platforms

- Demo Trading vs. Live Trading

- Essential Forex Trading Concepts

- Currency Pairs

- Pips and Spreads

- Leverage

- Margin

- Analyzing the Forex Market

- Technical Analysis

- Fundamental Analysis

- Making Trades in Forex Trading

- Types of Orders

- Long and Short Positions

- Setting Stop Losses and Take Profits

- Managing Risk in Forex Trading

- Risk Management Strategies

- Understanding Volatility

- Avoiding Common Trading Mistakes

- Developing a Forex Trading Strategy

- Setting Trading Goals

- Choosing a Trading Style

- Creating a Trading Plan

- Evaluating Performance

- Resources for Forex Trading

- Economic Calendars

- News Sources

- Trading Tools

- Conclusion

- FAQs

1. Understanding Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies with the goal of profiting from changes in their value. Forex trading takes place in the decentralized global foreign exchange market, where currencies are traded 24 hours a day, five days a week.

How Does Forex Trading Work?

Forex trading works by exchanging one currency for another currency. Currencies are traded in pairs, with the first currency in the pair known as the base currency and the second currency in the pair known as the quote currency. The exchange rate between the two currencies represents the price at which the quote currency can be bought or sold with the base currency.

2. Getting Started with Forex Trading

Finding a Broker

To get started with forex trading, you will need to find a reputable forex broker. Look for a broker that is regulated by a respected financial authority, offers competitive spreads and commissions, and provides a user-friendly trading platform.

Creating a Trading Account

Once you have found a broker, you can create a trading account. You will need to provide personal information and proof of identity and residence to comply with anti-money laundering regulations.

Understanding Trading Platforms

Forex trading platforms are software programs that allow you to access the forex market and make trades. Make sure to choose a trading platform that is user-friendly and offers the features and tools you need to analyze the market and make trades.

Demo Trading vs. Live Trading

Many brokers offer demo trading accounts that allow you to practice trading with virtual money before you start live trading with real money. Demo trading is a great way to get familiar with the trading platform and practice your trading strategy without risking any real money.

3. Essential Forex Trading Concepts

Currency Pairs

Currency pairs are the foundation of forex trading. Each currency pair represents the exchange rate between two currencies. The most commonly traded currency pairs include EUR/USD, USD/JPY, and GBP/USD.

Pips and Spreads

Pips and spreads are important concepts to understand in forex trading. Pips represent the smallest unit of movement in a currency pair, while spreads represent the difference between the bid price and the ask price.

Leverage

Leverage allows traders to control a large amount of currency with a relatively small amount of capital. For example, if a broker offers leverage of 100:1, a trader can control $100,000 of currency with only $1,000 of capital. However, leverage also increases the risk of losses, so it’s important to use it wisely.

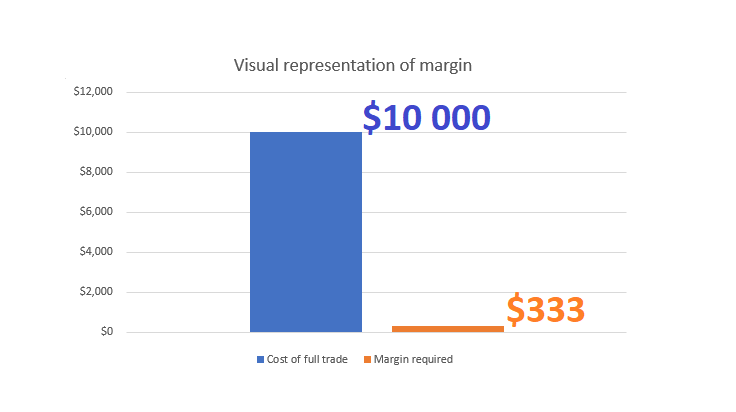

Margin

Margin is the amount of money that a trader must deposit with a broker in order to open a trading position. Margin requirements vary by broker and by currency pair, but they typically range from 1% to 5% of the total value of the position.

4. Analyzing the Forex Market

Technical Analysis

Technical analysis is the process of analyzing charts and other technical indicators to identify trends and potential trading opportunities. Common technical indicators used in forex trading include moving averages, trend lines, and Fibonacci retracements.

Fundamental Analysis

Fundamental analysis involves analyzing economic and political factors that can affect the value of currencies. Important economic indicators to watch include GDP, inflation, and unemployment rates, while political factors can include elections, policy changes, and geopolitical events.

5. Making Trades in Forex Trading

Types of Orders

Forex traders can use several types of orders to execute trades, including market orders, limit orders, and stop orders. Market orders execute at the current market price, while limit orders and stop orders are used to buy or sell at a specific price or when a certain condition is met.

Long and Short Positions

Forex traders can take either long or short positions on a currency pair. A long position involves buying the base currency and selling the quote currency, while a short position involves selling the base currency and buying the quote currency.

Setting Stop Losses and Take Profits

Stop losses and take profits are used to manage risk and lock in profits on a trade. A stop loss is a predetermined level at which a trade will be closed if it moves against you, while a take profit is a level at which a trade will be closed to secure profits.

6. Managing Risk in Forex Trading

Risk Management Strategies

Managing risk is an essential part of forex trading. Common risk management strategies include using stop losses, limiting leverage, and diversifying your trades across multiple currency pairs.

Understanding Volatility

Volatility is a measure of how much a currency pair’s price fluctuates over time. High volatility can increase the potential for profits, but it also increases the risk of losses.

Avoiding Common Trading Mistakes

Common trading mistakes in forex trading include overtrading, not using a stop loss, and trading on emotions rather than logic. To avoid these mistakes, it’s important to have a solid trading plan and stick to it.

7. Developing a Forex Trading Strategy

Setting Trading Goals

Setting trading goals can help you stay focused and motivated. Goals should be specific, measurable, and achievable.

Choosing a Trading Style

There are several trading styles to choose from in forex trading, including scalping, day trading, swing trading, and position trading. Each style requires a different approach and mindset.

Creating a Trading Plan

A trading plan outlines your trading strategy, including your goals, entry and exit points, risk management strategies, and more. It’s important to create a detailed plan and stick to it.

Evaluating Performance

Regularly evaluating your performance can help you identify areas for improvement and refine your trading strategy over time.

8. Resources for Forex Trading

Economic Calendars

Economic calendars provide information on upcoming economic events and indicators that can affect the forex market.

News Sources

Keeping up with the latest news and developments can help you stay informed and make more informed trading decisions.

Trading Tools

There

are several trading tools available for forex traders, including charting software, news feeds, and trading platforms. Choosing the right tools can help you make more informed trading decisions and manage your trades more effectively.

9. Conclusion

Forex trading can be a challenging but rewarding endeavor for those who are willing to put in the time and effort to learn. By understanding the basics of forex trading, analyzing the market, making trades, managing risk, and developing a trading strategy, you can increase your chances of success in the forex market.

10. FAQs

- Is forex trading a good way to make money?

- Forex trading can be a good way to make money, but it’s important to approach it with realistic expectations and a solid trading plan.

- How much money do I need to start forex trading?

- The amount of money you need to start forex trading depends on the broker you use and the size of the positions you want to trade. Some brokers allow you to trade with as little as $100, while others require larger deposits.

- How much time do I need to dedicate to forex trading?

- The amount of time you need to dedicate to forex trading depends on your trading style and goals. Some traders spend several hours a day analyzing the market and making trades, while others only trade occasionally.

- How can I minimize my risk in forex trading?

- You can minimize your risk in forex trading by using risk management strategies such as setting stop losses and limiting leverage, and by avoiding common trading mistakes such as overtrading and trading on emotions.

- What resources are available for learning about forex trading?

- There are several resources available for learning about forex trading, including online courses, trading books, and webinars. It’s important to choose reputable sources and to continue learning and improving your skills over time.